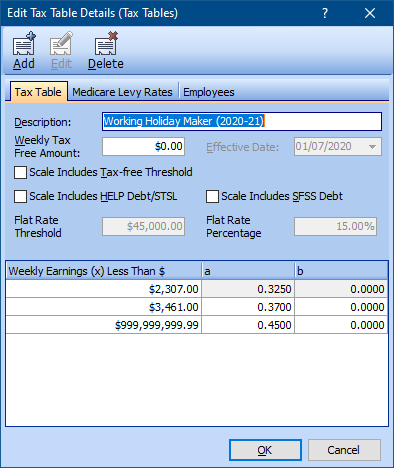

The Working Holiday Maker tax table in Wagemaster includes a Flat Rate Threshold, which sets the tax rate at 15% for the first $45,000 in annual earnings. Once this income threshold is reached, the tax will be calculated at marginal rates based on the income brackets, as per the 03 Non-Resident Tax Scale.

Please Note

This information applies to payments made on or after 13 October 2020 and has to be implemented by no later than 16 November 2020. The tables are dated 01/07/2020 and will calculate tax at the new rates for wages processed after Wagemaster has been updated with the new pdl.

To Setup Working Holiday Maker Tax Scale:

- Navigate to Setup > Tax > Tables > Working Holiday Maker (2020-21).

- Employee files allocated on the new Working Holiday Maker 2020-21 tax table will automatically be assigned to the Working Holiday Maker Income Type field code H, within that employee file for PAYG Summary and STP purposes.

TFN Declarations For Working Holiday Makers:

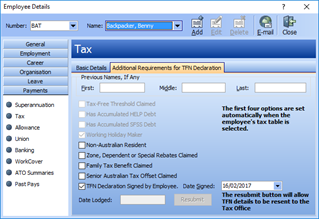

- Navigate to Employee > Payments > Tax – Additional Requirements for TFN Declaration.

Important

If you need to apply a custom tax amount you can only do so via the Adjustments section.

- Navigate to Employee > Payments > Tax - Basic Details.

- Then enter in the adjustment as a positive or negative a required.

For further information, please refer to the ATO website.

Comments